By Nikki Johnson, Regional Economist

Local governments in Hampton Roads, like their peers across the country, have spent the past several years navigating a volatile fiscal environment. The combination of pandemic-era shocks, the subsequent historic rise in inflation, and today’s economic uncertainty have created significant challenges for local budgets.

Nationally, the National League of Cities 2024 City Fiscal Conditions report showed that the post-pandemic rebound reshaped local government finances in several ways. Expenditures jumped in the immediate aftermath of the pandemic as demand for parks, recreation, and cultural services rose, while growing public safety needs placed additional pressure on budgets. Inflation magnified those pressures, driving up the cost of fuel, utilities, supplies, and purchased services across general operations. On the revenue side, property, sales, and income taxes all increased as housing markets strengthened, retail spending recovered, and unemployment fell. Federal support through the American Rescue Plan Act and the Bipartisan Infrastructure Law raised reported revenues while allowing local governments to maintain and expand services. By 2024, however, the pace of growth in revenues and expenditures slowed as federal aid tapered and municipalities shifted toward longer-term fiscal sustainability.

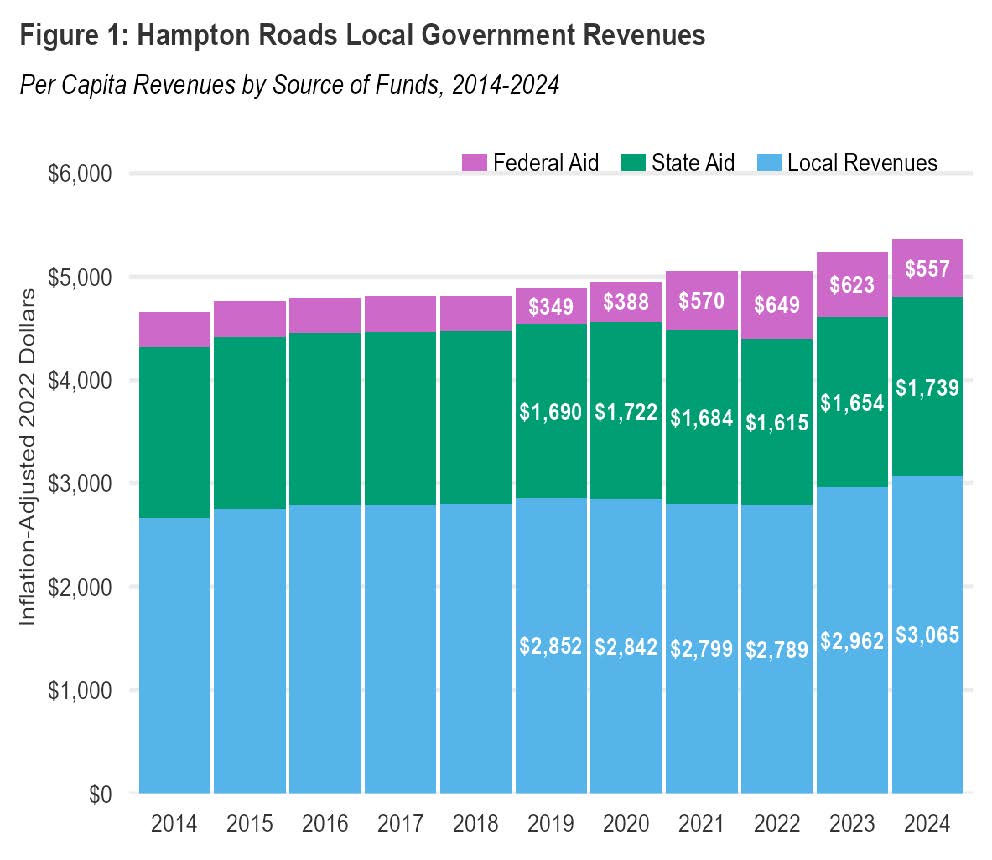

As illustrated in Figure 1, federal aid provided a significant lift to local government revenues in the region. Per capita federal transfers, which averaged under $400 before the pandemic, climbed to nearly $650 in 2022. They stayed elevated in 2023 before slipping to $557 in 2024 as aid begins to wind down. Local revenues, the backbone of municipal budgets, grew from about $2,850 per resident in 2019 to just over $3,000 in 2024, the highest level in a decade once adjusted for inflation. State aid, by contrast, has been relatively stable, hovering near $1,700 per resident. The pattern underscores a simple point. Federal dollars gave localities temporary breathing room, but the long-term capacity to sustain services rests overwhelmingly on local tax bases.

|  |

Data Sources: Bureau of Labor Statistics, Virginia Auditor of Public Accounts (APA).

|

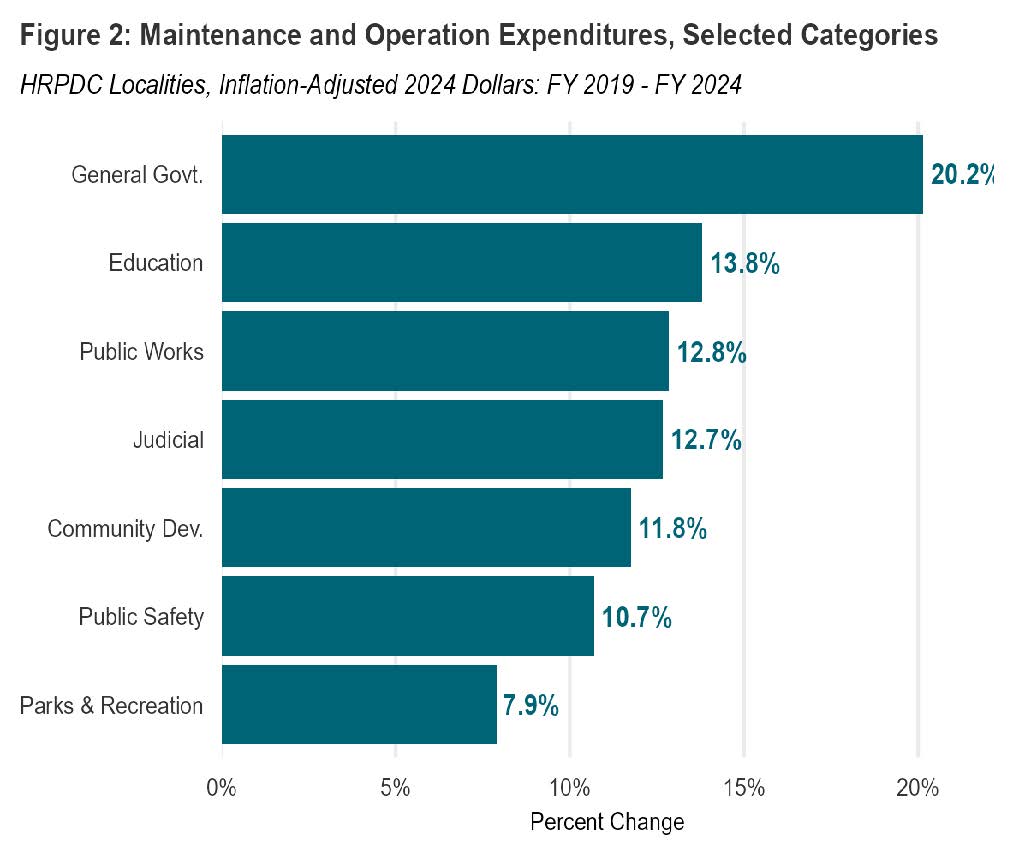

On the spending side (Figure 2), Hampton Roads localities have seen real increases in several major categories since 2019. General government costs grew the fastest, reflecting not only higher operating expenses such as fuel, utilities, and supplies, but also rising personnel costs in a tighter labor market.

Looking ahead, the federal aid that has supported local budgets since the pandemic is set to fully expire by 2026, with the final phase-out of ARPA funds. At the same time, reductions in federal spending are beginning to shift more costs onto state and local governments. For Hampton Roads, this means that the temporary relief of the past few years will give way to a heavier reliance on local revenues at a moment when inflation continues to put pressure on the cost of providing services.

More Information and Regional Indicators